- DeepSeek’s use of Nvidia’s low-powered A100 chips triggered a 17% drop in Nvidia’s stock, highlighting market volatility.

- Nvidia shares rebounded 19% after investor reassessment and rumors of DeepSeek potentially using advanced Nvidia chips.

- Despite minor overheating issues, demand for Nvidia’s products, including the new Blackwell accelerators, remains high.

- Nvidia’s GPUs are critical for advancements in AI and gaming, contributing to strong revenue growth and positive Wall Street forecasts.

- The stock is near a $150 ceiling, with some investors wary of its high valuation despite resilient market performance.

- Competition from companies like AMD and Intel presents ongoing challenges to Nvidia’s market dominance.

- Investors face a decision between capitalizing on Nvidia’s potential or considering the risks posed by escalating competition.

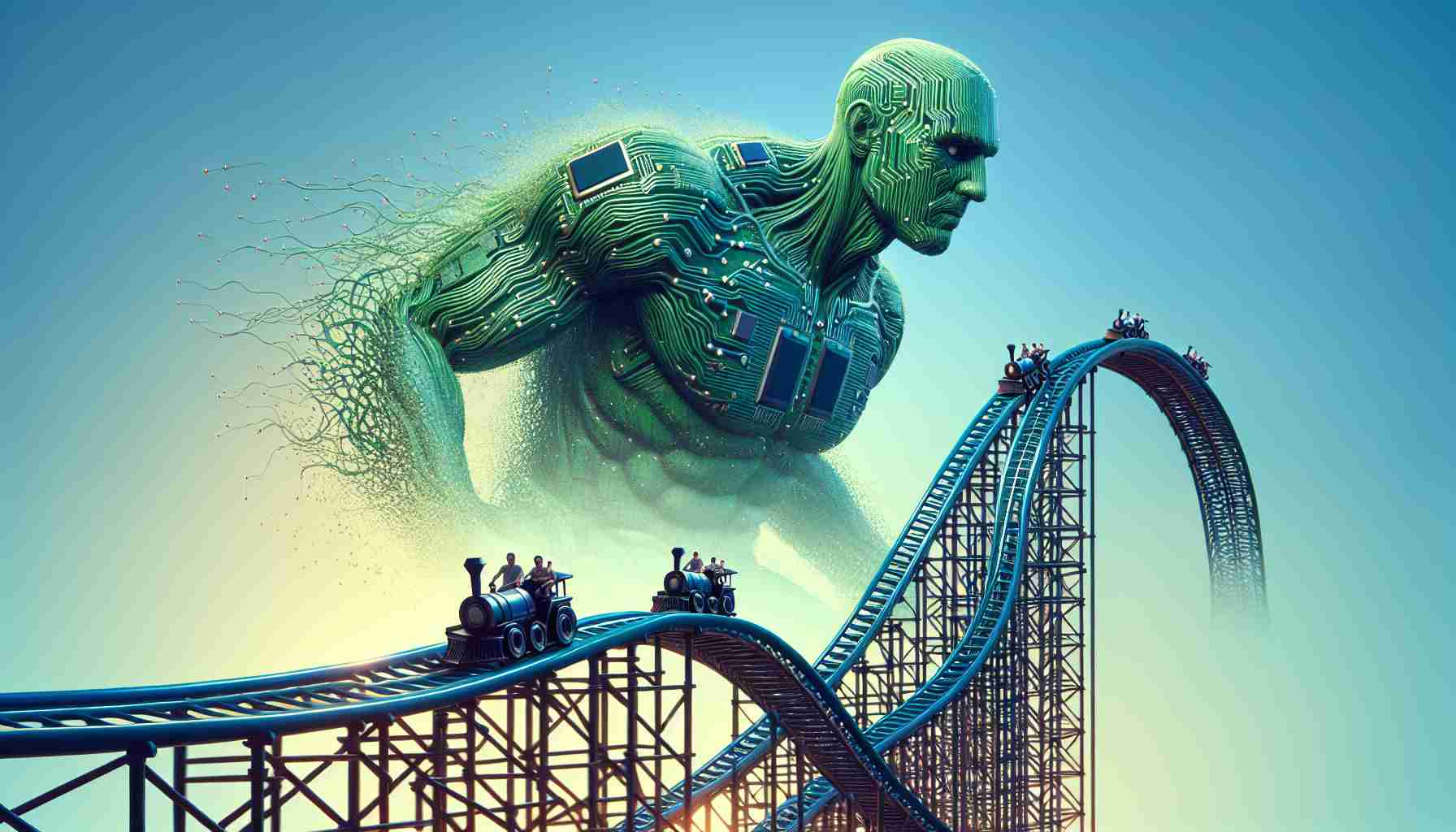

In the ever-volatile world of tech stocks, Nvidia recently faced a seismic jolt. Chinese AI lab DeepSeek unveiled a groundbreaking model using Nvidia’s own low-powered A100 chips, stirring concerns about sales of Nvidia’s premium AI accelerators. In a market where surprises rule, the news sent Nvidia’s stock plummeting by a jaw-dropping 17% in a single day. Yet, this wasn’t the end of Nvidia’s story.

In just ten days, Nvidia’s shares staged a dramatic comeback, soaring 19% as investors reevaluated the threat. Rumors hinted that DeepSeek might have been using Nvidia’s advanced chips all along, dampening initial fears. Furthermore, Nvidia’s demand remains robust despite minor overheating issues. Its advanced Blackwell accelerators are sold out, and plans for expanded production are in the works.

Nvidia’s grip on the AI and gaming sectors is unyielding, with its GPUs considered essential for cutting-edge developments in data centers and AI training. This has fueled Nvidia’s impressive revenue growth, supported by bullish endorsements from Wall Street analysts, who foresee a 24% upside potential.

Yet, as the tech giant marches towards its earnings report, the stock hovers precariously around a $150 ceiling. Some investors eye its valuation with caution, noting its lofty multiples. Nvidia’s dominance isn’t unchallenged; rivals like AMD and Intel continuously nipping at its heels with their AI-focused innovations.

For investors, the dilemma remains: is this a prime opportunity to jump on Nvidia’s bandwagon, or are the risks too steep as competitors close in? Nvidia’s future may be uncertain, but its resilience continues to capture the market’s imagination.

Is Nvidia’s Resilience Enough to Overcome New Challenges?

Nvidia’s Market Dynamics and Recent Events

The stock market’s volatility is nothing new, but Nvidia’s recent fluctuations underscore the unpredictable nature of tech stocks. After a sudden drop due to an announcement by Chinese AI lab DeepSeek about a new model using Nvidia’s A100 chips, Nvidia quickly rebounded. Investors speculated that DeepSeek might have used advanced Nvidia chips, recasting initial concerns and restoring confidence.

Pros and Cons of Investing in Nvidia

Pros:

– Market Dominance: Nvidia holds a strong position in AI and gaming, key sectors for current tech growth.

– Advanced Technology: With flagship products like the Blackwell accelerators and its dominance in GPUs, Nvidia remains at the technological forefront.

Cons:

– Valuation Concerns: The high stock multiples may indicate overvaluation, posing a risk to new investors.

– Competition: Companies like AMD and Intel are aggressively pursuing innovation in AI, challenging Nvidia’s hold on the market.

Market Forecast and Predictions

Analysts remain bullish on Nvidia’s future, predicting a 24% upside potential. However, the looming earnings report and competitive threats from AMD and Intel suggest volatility could persist. Nvidia aims to uphold strong revenue growth, aided by increasing AI and gaming demands, despite challenges like overheating issues and supply constraints.

Security Aspects and Innovations

Nvidia’s latest AI hardware, including the Blackwell series, is at the forefront of innovation. However, with cutting-edge technology comes increased risk of imitation and competition, notably from overseas companies that could leverage Nvidia’s models for their advancements.

Considerations for Potential Investors

Potential investors should weigh Nvidia’s strong track record and continued demand for GPUs against the risks of high multiples and competitive pressure. Staging advances in AI accelerators and data center applications, Nvidia is likely to sustain its robust growth trajectory.

Important Questions Answered

– Does Nvidia still hold significant competitive advantages in AI? Yes, despite competition, Nvidia’s technology and market reach remain formidable.

– Is Nvidia overvalued? Some investors feel the stock’s high multiples reflect overvaluation, though continued market confidence can dissipate these fears.

For more information about Nvidia and its industry standing, visit the official Nvidia website: Nvidia, or check analytical commentary on the tech stock market at sites like:Bloomberg and CNBC.