- Trump’s 25% tariffs on imports from Canada and Mexico could disrupt North American trade.

- Essential imports like lumber may see price increases, impacting affordable housing.

- Residents could face higher electric bills due to tariffs affecting power costs from British Columbia.

- Possible Canadian retaliation may hit U.S. exports, especially in aircraft and agriculture.

- Border communities may experience reduced Canadian shopper traffic, hurting retail sales.

- The tariffs could lead to higher consumer prices and increased inflation risk.

- Businesses might delay investments due to uncertainty in the economic climate.

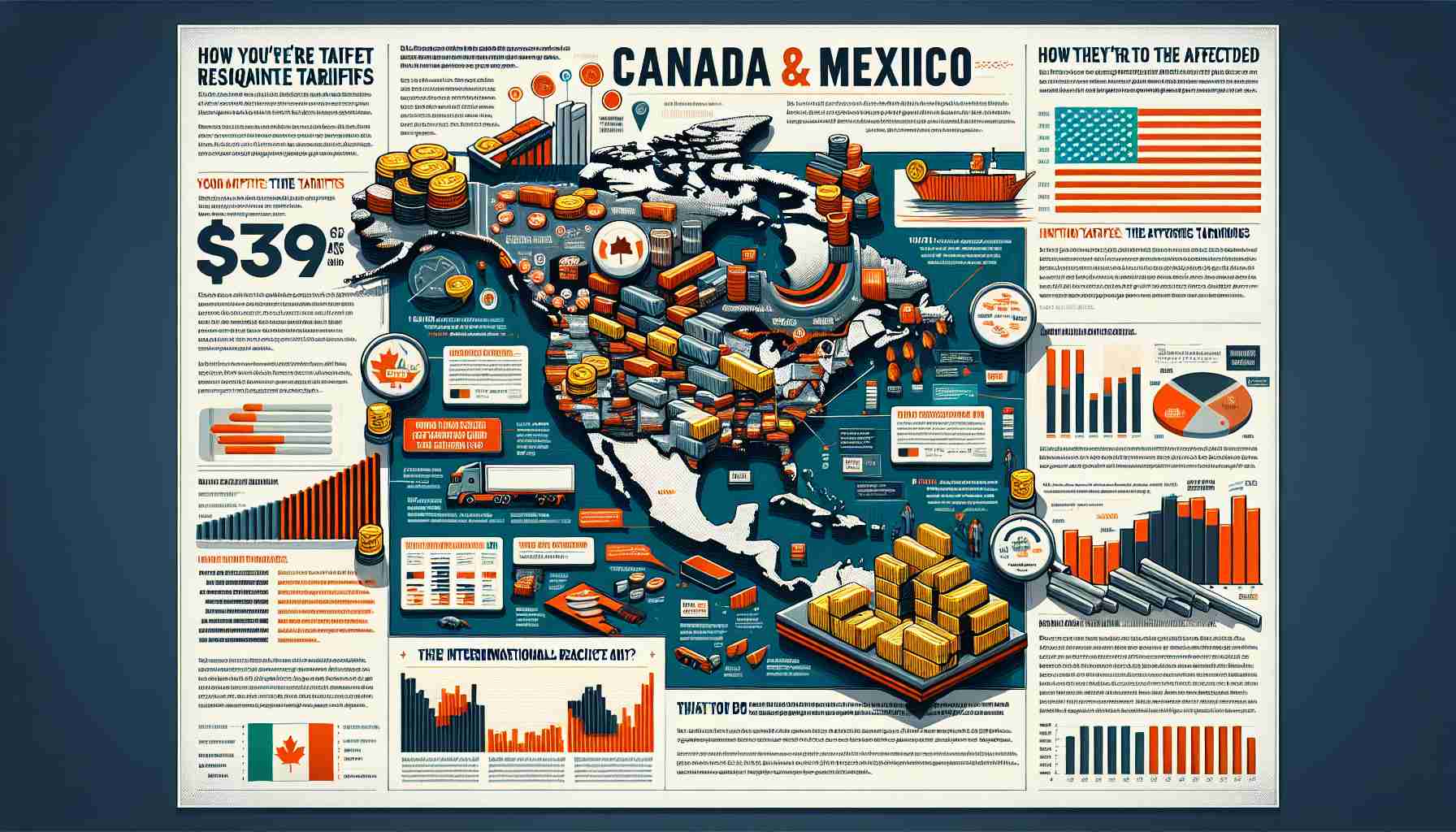

President Trump is making headlines with a bold move that could send shockwaves through the economy—a 25% tariff on imports from Canada and Mexico starting this Saturday. This decision aims to push both neighbors into enforcing stricter border controls, but it’s a significant turn away from the United States-Mexico-Canada Agreement (USMCA) signed by Trump just three years ago.

What does this mean for consumers and businesses, especially in Washington? Experts warn that the impact could be severe. Oil and gas prices may remain unchanged, but tariffs on essential imports like lumber could rise, exacerbating the already pressing issues of affordable housing. Additionally, rising costs for electric power from British Columbia could lead to higher bills for residents amid increased demand for electrification.

Retaliation from Canada might also loom large, putting pressure on Washington exports, including aircraft and agricultural products. Communities near the border, like Bellingham and Blaine, can expect a decline in Canadian shoppers, leading to fewer retail sales and increased consumer prices, heightening the risk of inflation.

This unprecedented move raises critical questions for businesses considering new investments. Will the economic activity slow down? The long-standing stability in North American trade relationships is now at risk, prompting many to reconsider their next steps.

The takeaway? Everyone should prepare for a potential ripple effect on daily life—from rising prices to slower economic growth—as these tariffs take shape across the region. Stay informed, as this dynamic situation unfolds!

Economic Shockwaves: What Trump’s New Tariff Could Mean for You!

Overview

President Trump’s recent decision to impose a 25% tariff on imports from Canada and Mexico has raised alarms across various sectors, especially among consumers and businesses in Washington. This move, which diverges sharply from the United States-Mexico-Canada Agreement (USMCA) established only three years prior, promises to create a ripple effect throughout the economy.

Key Insights and Market Trends

1. Increased Costs on Essential Goods: While oil and gas prices may remain stable, vital imports such as lumber are expected to see marked increases. This could further aggravate the ongoing housing crisis by worsening affordability issues.

2. Electricity Rates and Demand: Residents could face higher electricity costs due to tariffs on power imports from British Columbia, particularly as demand for electrification rises amid a focus on green energy solutions.

3. Potential Canadian Retaliation: Canada may respond with its own tariffs on U.S. exports, particularly impacting industries reliant on cross-border trade, such as agriculture and aerospace manufacturing. This can lead to a decrease in U.S. market competitiveness.

4. Consumer Behavior and Retail Impact: In border towns like Bellingham and Blaine, fewer Canadian shoppers are likely to be seen, which could drastically affect retail sales, further contributing to inflationary pressures.

5. Investment Uncertainty: With the stability of North American trade relationships now under threat, many companies are reassessing potential investments, potentially leading to a slowdown in economic growth.

Important Related Questions

1. What industries will be most affected by the tariffs?

Industries reliant on imports from Canada and Mexico, particularly construction (due to lumber tariffs) and agriculture (due to potential retaliatory tariffs), will experience immediate challenges. Additionally, manufacturers relying on electronic components and machinery will need to prepare for increased costs.

2. How will consumers personally feel the impact?

Consumers may notice rising prices in everyday goods, particularly in construction materials and housing-related expenses. The increase in electricity rates could also strain household budgets, especially for those transitioning to more electric-driven processes.

3. What long-term effects might result from these tariffs?

Long-term economic effects could include decreased cross-border trade, shifting supply chains as companies look for alternatives, and potential job losses in sectors heavily reliant on U.S.-Canada-Mexico trade. This could ultimately lead to slower economic growth throughout the region.

Conclusion

As these tariffs come into effect, they will likely reshape the economic landscape in Washington and beyond. Businesses and consumers alike must stay alert to changes that may affect prices and the availability of goods and services. The situation is fluid, and understanding these dynamics is crucial for planning ahead.

For further information and updates, visit White House for official announcements and analyses.